Monetizing NIL: Strategies for Athletes to Build Long-Term Financial Health

Monetizing NIL: Strategies for Athletes to Build Long-Term Financial Health

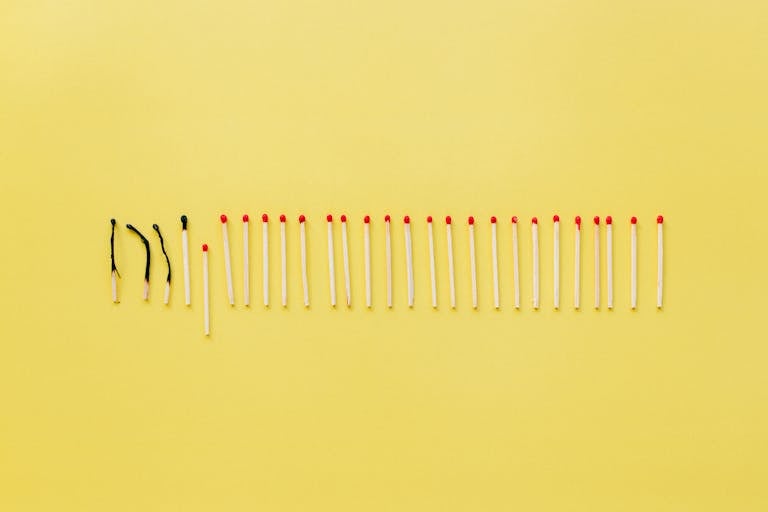

The NIL era is a game-changer for athletes. Not only does it provide opportunities to monetize your name, image, and likeness, but it also opens doors to build a lasting financial future. However, NIL income doesn’t last forever. The key to financial success in the NIL space is not just about making money—it’s about making smart decisions, setting up strategies for saving, investing, and building a legacy.

This article outlines practical strategies for athletes to monetize their NIL earnings wisely, ensuring long-term financial security that extends far beyond their athletic careers.

1. Set Financial Goals Before You Sign Deals

Before diving into any NIL deal, it’s crucial to have clear financial goals. What do you want to accomplish with the money you earn? This focus will help you make smarter decisions and avoid distractions.

- Short-term goals:

These might include paying off debt, saving for a major purchase, or setting up an emergency fund. - Long-term goals:

These goals might include investing for retirement, funding an education, or purchasing a home.

Having these goals in mind will help you prioritize how to use your NIL earnings. Setting goals can also guide you in determining whether you’re taking on too many NIL deals, or if some offers simply don’t align with your financial vision.

2. Build an Emergency Fund and Practice Smart Saving

An emergency fund is the first step in building long-term financial security. For athletes earning NIL income, it’s important to treat this as a “must-have” before spending money on anything else.

- How much to save:

Aim for 3–6 months of living expenses in an easily accessible savings account. This fund will give you the security of knowing that if anything unexpected happens—like injury, a bad NIL deal, or a drop in earnings—you have a financial cushion to fall back on. - Where to save:

Keep your emergency fund in a high-yield savings account to earn interest while keeping it liquid and accessible.

3. Invest for the Future: Build Long-Term Wealth

While NIL income provides a short-term boost, the key to lasting financial health is investing for the future. The earlier you start, the more you can capitalize on compound interest and grow your wealth over time.

- Start with retirement accounts:

A Roth IRA is a great option for young athletes, offering tax-free growth on investments. If you’re already working with a financial advisor, discuss setting up a Roth IRA as a way to save for retirement. Even small, consistent contributions will add up over time. - Diversify investments:

Don’t put all your eggs in one basket. Consider investing in stocks, bonds, and real estate as a way to create diverse sources of income. - Real estate investments:

If you have the financial ability, consider using some of your NIL income to start investing in real estate. Rental properties or even flipping homes can provide you with an additional stream of passive income.

4. Use NIL Earnings to Fund Education and Career Development

NIL earnings can be a valuable tool for building a career after sports. Don’t just think of NIL money as extra spending money—think of it as a career investment fund that can help you reach long-term career goals.

- Fund your education:

You can use NIL money to pay for college tuition, certifications, or specialized training programs that will set you up for a successful post-athletic career. - Develop marketable skills:

Invest in learning skills outside of sports, such as digital marketing, public speaking, or entrepreneurship. These skills will come in handy when transitioning from sports to a post-college career. - Start a business:

Consider using NIL earnings to kick-start a small business. Whether it’s a personal brand, a retail business, or a consulting service, NIL income can serve as seed money for your entrepreneurial dreams.

5. Protect Your Income—Create Passive Income Streams

Creating passive income is one of the best ways to secure long-term financial health. With NIL earnings, you can start building these income streams, which will continue to provide financial security after your athletic career is over.

- Start a brand or product line:

Use your personal brand to create a product line, whether it’s clothing, merchandise, or other consumer products. As your NIL grows, your business could generate passive income. - Content creation:

If you enjoy creating content, consider creating digital assets like courses, ebooks, or apps that can generate revenue while you sleep. - Real estate investments:

Property investments provide regular rental income and long-term property appreciation. Use some of your NIL income to begin investing in rental properties or real estate syndications.

6. Avoid Lifestyle Inflation—Live Below Your Means

With the influx of NIL deals, it’s easy to get caught up in the excitement and indulge in a higher standard of living. However, lifestyle inflation can quickly become a problem, especially once your NIL earnings slow down after college.

- Set limits:

Create a budget and make sure you don’t overspend just because you have more money coming in. - Avoid debt:

Don’t let NIL money lead to new debt. Stay within your budget and avoid using NIL earnings for things you don’t need, like expensive cars, lavish vacations, and flashy purchases. - Prioritize savings and investments over immediate gratification:

The earlier you invest, the greater the payoff. So, rather than spending on luxuries now, use your NIL money to secure your future.

7. Seek Financial Advice—Work With Professionals

Managing your money, especially as your NIL income increases, can be complex. Seeking advice from financial professionals will ensure that you’re on the right track and making the most of your earnings.

- Work with a financial advisor:

A financial advisor can help you with budgeting, saving, investing, and retirement planning. They can also help you avoid common pitfalls, such as mismanaging tax liabilities or overspending. - Consult a tax expert:

NIL earnings are taxable, and mismanaging your taxes could result in penalties or missed opportunities. A tax expert can help you plan for quarterly tax payments, maximize deductions, and avoid mistakes that could impact your financial future.

8. Stay Disciplined—Review Your Finances Regularly

Financial success comes down to discipline. Make sure you review your finances at least once a quarter to ensure you’re staying on track with your goals.

- Track progress:

Are you hitting your savings goals? Are you investing in your future? Regularly check your progress and make adjustments as needed. - Adapt to changes:

Your NIL income might fluctuate. As things change, ensure that you’re adjusting your financial plan to maintain long-term stability.

Final Thoughts

NIL isn’t just an opportunity to make money—it’s an opportunity to build a strong, lasting financial future. By managing your NIL income wisely, setting clear goals, and investing in your future, you can create wealth that lasts long after your athletic career is over.

The key is to view NIL as more than just a financial boost—it’s a tool for creating long-term financial health and career success.